Cash transactions have always played a major role and serve as a constant source of black revenue collection. The government has recently introduced a variety of measures to curb trade in cash payments and improve digital payments. To monitor the use and distribution of black money, governments have been imposing additional restrictions on money laundering.

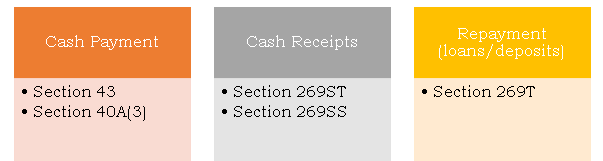

The Income Tax Act provides for allowable expenses such as deductions for payments of more than Rs 20,000 in one day i.e. payment is made in any other way than electronic clearing system or account cheque or account draft will not be allowed as a deductible expense.The Income Tax Act provides for the recognition of payments as profits and benefits from business or employment if costs over INR 20,000 are made in any year, however, payment is made in any subsequent year otherwise by electronic clearing system or account or account draft.

It deals with the limit on the amount of cash transactions.Under Section 40A (3), if the expenses are made more than Rs.10,000, then payment is not permissible under the Income Tax Act, 1961.It is, therefore, important that all taxpayers, if they make any payment above Rs.10,000, must pay by bank channels such as bank card, account transfer, check, or DD (Demand Draft).

This section says that if payment of more than Rs.10,000 is made for the acquisition of an asset in cash, the expenses will be disregarded to determine the actual cost of the asset. Therefore, taxpayers must pay the seller through banking channels in such situations.

Section 269ST of the Income Tax Act, 1961states that no individual can get INR 2 lakhs or more in cash:

The provisions of Section 269ST are not applicable if amounts exceeding Rs.2 lakhs are received in cash from the following persons:

This section is introduced to restrict the use of black money on various occasions such as weddings, travel, etc. and no deduction is required by the payer under tax laws.You may not receive any gift exceeding Rs 2 lakh in cash or in cases where the gifts may be regarded as your income like gifts received during your marriage or by certain relatives.

As per Section 269T any branch of a banking organization and any other person may not be able to repay a loan or make a deposit unless a check for an account payment or a draft drawn on that person’s name, loan or deposit., if:

The provisions of section 269T are non-applicable if the loan is repaid or the deposit is taken/received from the person mentioned hereunder:

Section 269SS prohibits the taxpayer from taking a loan or deposit or amount above Rs.20,000 in cash.All debts and deposits above Rs.20,000 must always be taken through the varied bank channels. This section makes an exception in cases where a person giving loans or deposits is-

In certain payments where you are eligible to apply for deductions from your taxable income, tax laws have a certain limitation on cash payment. Deductions under Section 80D are not allowed if the health insurance premium is made in cash. However, payment for a health check, with a minimum limit of Rs 5,000 under Section 80D, can be made in cash. Cash payment limits will also apply in the event of deductions under the same category of medical expenses for an elderly person who does not have health insurance. Similarly, claims for the certain seizure of donations under Section 80G cannot be made if the donation above Rs 2,000 is in cash. A limit of Rs 2,000 applies to each donation and not to all donations when combined.

Therefore, a person needs to take full care while working with a transaction as it may result in the form of large fines and allowances or deductions. In India laws related to Income tax do not allow transactions in cash for any purpose beyond the Rs 2 lakh of limit. Even if you get money from any of your relatives, it applies. A person cannot receive more than Rs 2 lakh from close relatives in one day.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.