The Bangladesh Bank (BB) has revealed its Monetary Policy Statement (MPS) for the period of July-December 2022 at a challenging time. The global economy is experiencing an inflationary pressure that has not been felt in the recent past. Countries are struggling to overcome the shocks caused by the Covid-19 pandemic and the ongoing Russia-Ukraine war. In this context, BB has announced its MPS with its usual three objectives: inflation control, employment generation, and growth of gross domestic product (GDP).

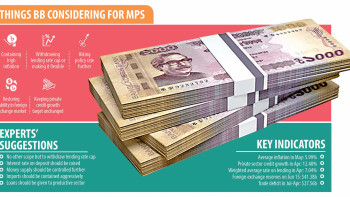

To achieve them, the MPS puts forward a list of areas where the central bank wants to intervene through policy actions. But the stated measures are not enough. While following a tight monetary policy to rein in inflation and reduce exchange rate pressure, BB also aims to support the economic recovery process through ensuring funds to the productive sectors and employment-generating activities. The monetary policy will also promote import-substituting economic activities. To reduce exchange rate depreciation pressure, protect the foreign exchange reserves and control inflation, the policy will discourage imports of luxury goods, and many foreign goods.

The projections of major economic and monetary indicators are ambitious and overlook the realities to a great extent. The MPS projects the inflation rate to be 5.6 percent in FY2022-23. This is optimistic in the context of the current global economic trend and the outlook for 2023. International organisations such as the World Bank have forecasted that several countries might face recession and stagflation in the coming days – as was experienced in the 1970s. If Bangladesh's inflation is mostly imported, then how does one expect it to come down so fast within a year while the global economy continues to struggle? According to the International Monetary Fund (IMF), in 2022, the emerging and developing countries will face an inflation rate of 8.7 percent. The situation will improve in 2023, but these countries will still suffer a 6.5 percent inflation. It may be noted that in May 2022, inflation in Bangladesh increased to 7.42 percent.

Additionally, as per the MPS, low inflation will be coupled with high economic growth in the country. Hence, the GDP growth is projected to be 7.5 percent – which has also been mentioned in the proposed national budget for FY2022-23. The optimism has been expressed in view of factors such as the economic boost due to the recently inaugurated Padma Bridge. The bridge will surely enhance economic activities and investment leading to higher growth, but one year is too short a time to observe such a jump.

The MPS has adopted "a cautious policy stance with a tightening bias to contain inflation and exchange rate pressures while supporting the economic recovery process." However, some of the projections are not consistent with this objective. It projected credit growth to the private sector at 14.1 percent for FY2022-23, which is higher than the estimated 13.1 percent for FY2021-22. Of course, originally it was set at 14.8 percent for FY2021-22. Therefore, the projected growth of credit to the private sector is not lower than the estimated actual growth in the previous year. The growth of the public sector credit is set at 36.3 percent in FY2022-23, which is higher than 27.9 percent in FY2021-22. The broad money growth is projected to rise to 12.1 percent in FY2022-23 from 9.1 percent in FY2021- 22 as per the MPS.

In view of supply constraints, commodity prices have risen beyond consumers' affordability. The ongoing inflation is happening in a situation when economies are also experiencing low growth due to the pandemic. People have less money at their disposal. Therefore, policymaking for controlling this inflation is much harder than the inflation due to a booming economy. However, many central banks around the world are currently pursuing a contractionary monetary policy to curtail the money supply, by using tools such as interest rates, and buying and selling of government securities, which is termed as open market operations.

To put it simply, a higher interest rate is adopted to reduce individual consumption. Households may feel encouraged to save and spend less due to attractive interest rates. On the other hand, since loans also become expensive due to higher interest payments, there will be further reduction in consumption. This is expected to reduce money supply in the market. In case of open market operations, central banks sell securities to other banks, which puts upward pressure on interest rates and reduces money supply in the market.

In using monetary policy tools, the Bangladesh Bank has increased its policy rate – or the repurchase agreement (repo) rate – by 50 basis points, from 5 to 5.5 percent, to deal with the demand side pressure. Repo is the short-term purchase of government securities by banks with the agreement to sell them back within a fixed time. The decision to raise policy rate is a positive move as it is an important tool for determining the interest rate. However, increased policy rate does not mean much, since the cap on banks' lending rate remains at nine percent and the weighted average nominal lending rate came down to 7.08 percent in May 2022.

With such interventions of the central bank, the monetary policy tools become dysfunctional. Banks don't find it attractive to lend money. Conversely, businesses also feel dissatisfied with banks on account of higher lending rates. Therefore, interest rates should be market-determined and adjusted automatically, based on the demand for credit and supply of funds. Deregulated interest rates will also help control imports and help stabilise the forex reserve. The MPS mentions that the central bank will observe the lending cap issue and take policy measures if needed. Instead of such ad hoc decisions, it should adopt a modern monetary policy that allows for a flexible interest rate regime for reduced inflationary pressure and stable forex reserves.

Dr Fahmida Khatun is executive director at the Centre for Policy Dialogue (CPD). Views expressed in this article are the author's own.